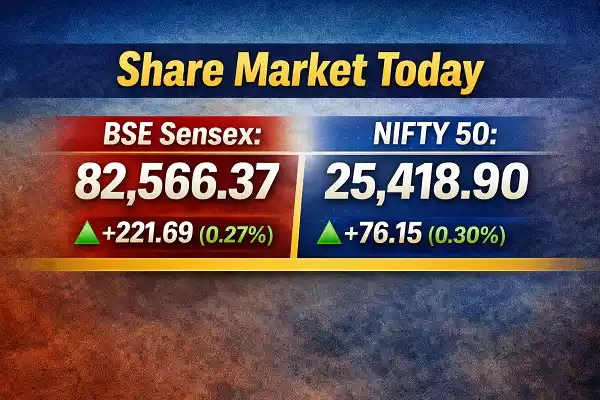

- Sensex up 222 points; Nifty closes above 25,400 for the third straight gain.

- Metals, realty, private banks lead; FMCG, IT, auto lag.

- Economic Survey optimism offsets global risk from U.S.–Iran tensions.

Sensex Nifty today extended their winning streak to a third session as domestic equities rebounded on optimism from the Economic Survey’s growth outlook. The Sensex climbed 221.69 points (0.27%) to 82,566.37, while the Nifty gained 76.15 points (0.30%) to 25,418.90 in a volatile trade.

Breadth was mixed with 1,640 advances, 2,424 declines, and 138 unchanged. Midcap and smallcap indices ended with marginal gains.

Sector Rotation: Metals Shine, FMCG and IT Underperform

Sectoral trends showed clear rotation. Metals, realty, private banks, power, energy, and oil & gas rose 0.6–3% on firm commodity prices and risk-on buying.

Meanwhile, pharma, PSU banks, IT, FMCG, and auto slipped 0.7–1%, capping broader gains.

On the Nifty, L&T, Tata Steel, Eternal, Axis Bank, and Tata Motors Passenger Vehicles led the rally. Asian Paints, SBI Life, InterGlobe Aviation, Maruti Suzuki, and Tata Consumer were among laggards.

Economic Survey Lifts Sentiment Despite Global Risks

Investors drew confidence from the FY26 Economic Survey, which highlighted resilient growth, anchored inflation, and financial-sector stability despite rising geopolitical and financial risks globally.

The report emphasized manufacturing-led exports, integration into global value chains, infrastructure expansion, deregulation, skilling, and AI-led transformation to sustain India’s potential growth near 7%.

However, elevated crude oil and bullion prices amid escalating U.S.–Iran tensions tempered risk appetite.

Bank Nifty Signals Technical Strength Ahead of Budget

The Bank Nifty closed decisively above its 20-day SMA, forming a bullish candlestick pattern. Momentum indicators, including an RSI bullish crossover, signal improving buying strength.

Analysts expect Bank Nifty to trade in a 59,000–60,400 range in the near term, with volatility likely ahead of the Union Budget.

Rupee Weakens Slightly

The Indian rupee ended lower at 91.95 per dollar compared to the previous close of 91.79, reflecting mild pressure from global cues.

Despite near-term swings, the undertone remains positive as domestic macro signals continue to support equity sentiment.

Disclaimer:

The information provided in this blog is for educational and informational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instruments. Stock market investments are subject to market risks. Past performance is not indicative of future results. Readers are advised to consult a qualified financial advisor before making any investment decisions. The author and publisher are not liable for any losses or damages arising from the use of this information.

You May Like

Trending Searches Today |

- Odisha Investment Proposals ₹44,200 Crore Cleared to Boost Energy, Semiconductor and Industrial Growth

- Horoscope Today: Zodiac Predictions for Love, Career and Health

- Angul Forest Picnic Ban 2026 Enforced to Prevent Devastating Summer Fires

- Horoscope Today For Aries to Pisces Predictions for Love, Career, Health and Fortune

- NASA Targets March 6 Launch for Crewed Lunar Mission