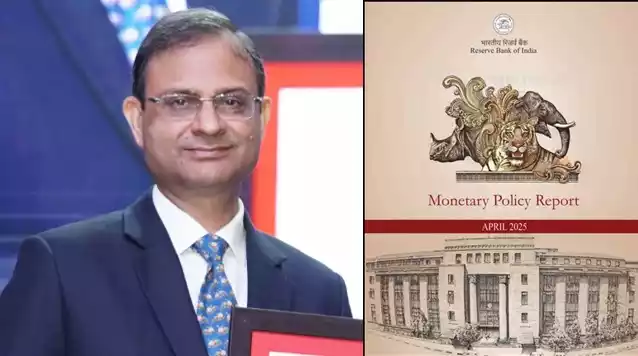

The Reserve Bank of India (RBI) announced its first monetary policy decision for the financial year 2025-26 (FY26) on Wednesday, against the backdrop of rising global trade tensions caused by recent U.S. tariff increases. RBI Governor Sanjay Malhotra stated that the new fiscal year has begun under uncertain conditions.

“The global economic landscape is evolving rapidly. Recent trade-related measures have intensified economic uncertainties across various regions, creating new challenges for global growth and inflation,” Malhotra remarked in his speech.

He further noted that in the midst of these uncertainties, the U.S. dollar has weakened considerably, bond yields have dropped significantly, equity markets are undergoing corrections, and crude oil prices have hit their lowest levels in over three years.

The announcement comes amid growing concerns about a global economic slowdown, with U.S. protectionist policies affecting emerging markets, including India.

In its previous policy review in February, the RBI had reduced the benchmark repo rate by 25 basis points to 6.25%, marking its first rate cut in nearly five years.

Key Highlights from the RBI Monetary Policy Committee:

- In a bid to ease loan EMIs and support an economy struggling due to retaliatory U.S. tariffs, the RBI has once again reduced the repo rate by 25 basis points, bringing it down from 6.25% to 6.0%.

- The GDP growth forecast has been revised downward to 6.5% from the earlier estimate of 6.7% due to global economic uncertainties.

- The projected GDP growth rate for each quarter is as follows: Q1 – 3.6%, Q2 – 3.9%, Q3 – 3.8%, and Q4 – 4.4%.

- Consumer Price Index (CPI) inflation for FY26 is expected to be 4%, with quarterly projections of 3.6% for Q1, 3.9% for Q2, 3.8% for Q3, and 4.4% for Q4.

- Food inflation dropped to a 21-month low of 3.8% in February, primarily due to a seasonal decline in vegetable prices.

You May Like

Trending Searches Today |

Odisha government endorses proposal to offer three nutritious laddoos each week