- Over 4.53 crore Sukanya Samriddhi Yojana accounts opened in 11 years.

- Total deposits crossed ₹3.33 lakh crore by December 2025.

- The scheme offers 8.2% interest, tax benefits, and long-term security for girls.

New Delhi: The number of Sukanya Samriddhi Yojana accounts has crossed 4.53 crore over the past 11 years, reflecting growing trust in the flagship savings scheme aimed at empowering the girl child, the government said on Wednesday. Launched in January 2015, the scheme has mobilised deposits exceeding ₹3.33 lakh crore by December 2025.

Officials said the milestone underscores the scheme’s role in combining financial inclusion with social transformation at the grassroots level.

Flagship Scheme Under Beti Bachao, Beti Padhao

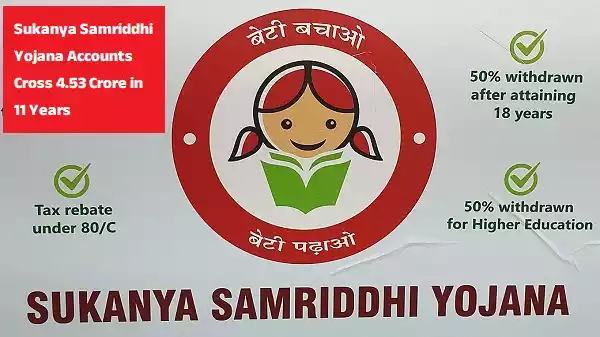

The Sukanya Samriddhi Yojana was introduced as part of the Beti Bachao Beti Padhao initiative to encourage families to plan early for their daughters’ education and future needs. The government said the scheme has helped instil confidence, inclusion and long-term financial planning among millions of households.

“As the SSY completes 11 years on January 22, it stands as a testament to the collective faith of families in the promise of their daughters,” the statement said.

Deposits Cross ₹3.33 Lakh Crore

According to official data, total deposits in SSY accounts have crossed ₹3,33,000 crore as of December 2025. The scheme currently offers an interest rate of 8.2% per annum, among the highest for savings instruments dedicated exclusively to girl children.

The interest rate is notified periodically by the Ministry of Finance.

Eligibility and Account Opening Rules SSY

Parents or legal guardians can open an SSY account for a girl child at any India Post office or at branches of public sector banks and authorised private banks, including HDFC Bank, Axis Bank, ICICI Bank and IDBI Bank.

An account can be opened from the birth of the girl child until she attains 10 years of age. Only one account is permitted per girl child, with a maximum of two accounts per family.

Deposits, Control and Transferability

The account can be opened with a minimum deposit of ₹250, while the maximum annual contribution is capped at ₹1.5 lakh. Deposits can be made for up to 15 years from the date of opening.

The account is managed by the parent or guardian until the girl turns 18, after which she can operate it independently upon submitting the required documents. The account is also transferable anywhere within India.

Building Long-Term Financial Security

The Sukanya Samriddhi Yojana is designed to provide long-term financial security through attractive interest rates, tax benefits and flexible withdrawal options for education and other future requirements.

Government officials said the sustained growth in accounts and deposits highlights the scheme’s success in promoting savings, financial discipline and empowerment of the girl child across the country.

You May Like

Trending Searches Today |

- Banakalagi Niti at Puri Jagannath Temple: Darshan Closed for 4 Hours

- Finn Allen Fastest T20 World Cup Century Sends New Zealand to Final

- Daily Horoscope March 6 2026: Career, Money and Health Predictions

- Bhubaneswar Traffic Restriction During Amit Shah Visit on March 5–6

- Elephant Attack in Mayurbhanj Kills 35-Year-Old Man in Rasgovindpur Range

Amazon Online Shopping

- Semi-automatic washing Machine : Economical, Low water and energy consumption, involves manual effort; Has both washing …

- Capacity – 10.5 kg (wash) | 8.0 Kg (Spin Tub Capacity) : Suitable for large families

- Energy Rating 5 Star: Best in class efficiency | Energy Savings; Energy consumption – 0.0084 KWh/kg/cycle & Water Consum…