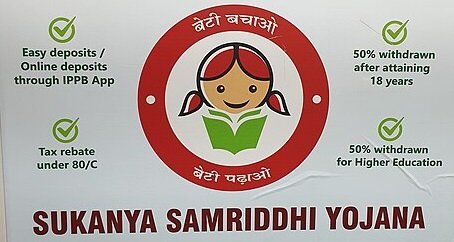

Sukanya Samriddhi Yojana: Every parent in India dreams of providing their daughter with the best possible education, career opportunities, and a financially secure future. However, with the rising costs of higher education, coaching, and marriage-related expenses, this dream often seems challenging. To support families in securing the future of the girl child, the Government of India introduced the Sukanya Samriddhi Yojana (SSY) under the Beti Bachao, Beti Padhao campaign.

This scheme is one of the most trusted and popular small savings schemes available today. It not only guarantees safe and assured returns but also provides tax benefits. With disciplined yearly deposits, parents can build a large, tax-free fund that ensures their daughter’s financial independence in adulthood.

Key Features of Sukanya Samriddhi Yojana

| Feature | Details |

|---|---|

| Scheme Type | Government-backed small savings scheme for girl children |

| Interest Rate | 8% per annum (compounded annually) |

| Minimum Deposit | ₹250 per year |

| Maximum Deposit | ₹1.5 lakh per year |

| Deposit Period | 15 years |

| Maturity Period | 21 years from account opening |

| Tax Benefits | Deposits qualify for tax deduction under Section 80C; maturity amount is 100% tax-free |

| Eligible Beneficiary | Girl child from birth till the age of 10 years |

| Number of Accounts | One account per girl child; maximum of two accounts per family (exceptions in case of twins/triplets) |

What is Sukanya Samriddhi Yojana (SSY)?

The Sukanya Samriddhi Yojana is a government-backed savings scheme exclusively designed for the welfare of girl children. It offers higher interest rates compared to many traditional savings schemes, and the maturity amount is completely tax-free.

The scheme allows parents or legal guardians to open an account in the name of a girl child any time from her birth until she turns 10 years old. Deposits can be made for 15 years, and the account matures after 21 years from the date of opening.

How ₹35,000 Per Year Becomes Over ₹16 Lakh

One of the most attractive aspects of the Sukanya Samriddhi Yojana is the power of compounding. Even a modest yearly deposit can generate a large corpus at maturity.

Here’s an example:

| Particulars | Amount |

|---|---|

| Annual Deposit | ₹35,000 |

| Total Investment Over 15 Years | ₹5.25 lakh |

| Total Interest Earned @ 8% | ₹10.91 lakh |

| Maturity Value After 21 Years | ₹16.16 lakh |

This calculation shows that while parents deposit only ₹5.25 lakh, the majority of the corpus — ₹10.91 lakh — comes from interest earnings. This demonstrates why SSY is considered one of the best schemes for long-term wealth creation.

Why Sukanya Samriddhi Yojana is the Best Choice for Parents

- Government-Backed Security: As a scheme managed by the Government of India, SSY offers complete safety for your savings.

- High Returns: With an 8% annual interest rate, the scheme outperforms many other small savings and fixed deposit options.

- Tax-Free Benefits: Contributions qualify for deduction under Section 80C, and the entire maturity corpus is completely tax-free.

- Long-Term Support: By the time your daughter reaches adulthood, the fund provides a substantial, risk-free amount for higher education or marriage.

- Encourages Financial Discipline: Regular deposits over 15 years inculcate the habit of savings while building a significant tax-free wealth.

Eligibility and Account Rules

- The account can be opened for a girl child any time from birth till she turns 10 years old.

- A family can open a maximum of two SSY accounts for two daughters. (Exception: More than two accounts allowed in case of twins/triplets.)

- The account requires a minimum annual deposit of ₹250.

- Deposits can be made up to ₹1.5 lakh per year.

- The parent/guardian has to make deposits for 15 years, after which no further contribution is needed.

- The account matures after 21 years, but partial withdrawals are allowed after the girl turns 18 years old.

Documents Required for Sukanya Samriddhi Yojana

To open an SSY account, the following documents are needed:

- Birth certificate of the girl child

- Proof of identity of the parent/guardian (Aadhaar card, PAN card, etc.)

- Proof of residence (ration card, voter ID, utility bill, etc.)

- Recent passport-size photographs of the parent/guardian and child

- Initial deposit slip for opening the account

Frequently Asked Questions (FAQs)

1. What is the current interest rate of Sukanya Samriddhi Yojana?

The current interest rate for SSY is 8% per annum, compounded annually.

2. How many years do I need to deposit money?

Deposits are required for 15 years, but the account will mature after 21 years.

3. Can money be withdrawn before maturity?

Yes, 50% of the balance can be withdrawn once the girl turns 18 years old, for education or marriage purposes.

4. How many accounts can be opened under SSY?

One account per girl child. A family can open up to two accounts (for two daughters).

5. Is the maturity amount taxable?

No. Both deposits and maturity corpus are 100% tax-free under Section 80C of the Income Tax Act.

6. Can NRIs open a Sukanya Samriddhi Yojana account?

No. Only residents of India are eligible to open an SSY account.

7. What happens if I miss a yearly deposit?

A penalty of ₹50 per year will be charged, and the account can be revived once the minimum deposit is made.

8. Can I transfer the SSY account?

Yes, the account can be transferred anywhere in India in case of relocation of the parent/guardian.

Get Latest News Live on MTIMES along with Breaking News and Top Headlines, Political News and around The World.

You May Like

Trending Searches Today |

Congress Criticises Government’s GST Reform, Says True GST 2.0 Reform in India Still Awaited

SSC CGL New Exam Date 2025 Out: Tier 1 Scheduled from 12th to 26th September

OSSSC Re-Conducts Preliminary Exam 2023: RI, ARI, Amin, Supervisor and SFS Posts from October 8

56th GST Council Meeting: Big GST Rate Cuts Announced, Focus on Common Man and Key Sectors

Undersea Cable Cuts in Red Sea Disrupt Internet Across Asia and Middle East

- Meet Galaxy S25 Ultra, your true AI companion. Powered by the next chapter of Galaxy AI with multi-modality, and the mos…

- Need to do multiple tasks? Galaxy S25 Ultra performs seamless actions across apps and will get them done for you instant…

- Live to create? Galaxy S25 Ultra’s cutting-edge camera and visual creation tools offer you the best camera and editing e…

- GALAXY AI – Welcome to the era of mobile AI. With Galaxy S24 Ultra in your hands, you can unleash whole new levels of cr…

- ELEGANCE MEETS DURABILITY – Meet Galaxy S24 Ultra, the ultimate form of Galaxy Ultra with a new titanium exterior and a …

- EPIC SHOTS, NO EFFORT – With the most megapixels on a smartphone and AI processing, Galaxy S24 Ultra sets the industry s…

- GALAXY AI – Welcome to the era of mobile AI. With Galaxy S24 Ultra in your hands, you can unleash whole new levels of cr…

- ELEGANCE MEETS DURABILITY – Meet Galaxy S24 Ultra, the ultimate form of Galaxy Ultra with a new titanium exterior and a …

- EPIC SHOTS, NO EFFORT – With the most megapixels on a smartphone and AI processing, Galaxy S24 Ultra sets the industry s…